The scope of services of M&P

- Implementation of carbon-neutral operation for all assets belonging to long-standing partner Hines by 2040 – with the following measures:

- Inspection of the properties with the project team, FM service provider on-site and the property managers and asset managers from Hines

- Creation of a Net Zero Carbon Roadmap

- Use of the ‘M&P Sustainability Toolbox’ – adapted to the needs of the real estate company

- Identification of energy-efficiency measures in building automation

- Substitution of CO2 emissions with a focus on restructuring the heat supply through district heating and heat pumps

- Measures for sustainable energy generation through photovoltaics

Hines Immobilien GmbH is focused on the decarbonisation of the buildings managed by the company. The aim is to enable carbon-neutral operation of the assets by 2040. To implement its ambitious sustainability goals, the industry giant is relying on its long-standing partner, M&P.

Hines is a globally active real estate investment, development and management company. It was founded in 1957 by Gerald D. Hines and is now active in 30 countries. Hines has been involved in the German market since 1991 and is now one of the largest real estate asset managers, with 149 employees (as of 03/2024) at five sites. The company is a long-standing customer of M&P in the energy and engineering business segments. And for good reason: it is a forerunner in the field of sustainability – and relies on the pioneering expertise of our Group in that regard.

A triad of energy efficiency: ESG, CRREM, M&P

Particular weight is given to compliance with ESG (Environment, Social, Governance) criteria, which is already mandatory for many companies. Hines plans to operate all assets under its management worldwide in a carbon-neutral manner by 2040 at the latest. The Hines European Core Fund (HECF) has imposed even stricter conditions on itself. The European assets of the HECF portfolio are expected to be decarbonised by 2030 (for Scope 1 and 2; Scope 3 by 2040). Hines’ targets go well beyond those of CRREM (Carbon Risk Real Estate Monitor). CRREM supports the real estate industry in decarbonisation and sustainable investments in existing buildings. It assesses the condition of assets with regard to energy and emissions data and determines stranding risks and the potential to renovate buildings. CRREM’s decarbonisation pathways are aligned with the Paris climate goals. Setting off on this path is absolutely essential, especially for the real estate industry. It is responsible for about 38% of energy consumption and 29% of all greenhouse gas emissions in the EU. The EU’s aim is to fully decarbonise the building sector by the year 2050.

Hines leads the way in Europe together with M&P – and is blazing a trail for the real estate industry

Founded in 2006, the Hines European Core Fund (HECF) is building a diversified portfolio of high-quality assets in urban locations within major European cities. Thanks to its future-ready management strategy, the fund has been recognised as a market leader in terms of sustainability in the GRESB ranking for many years (GRESB is an internationally recognised evaluation and benchmarking system for sustainability, especially in the real estate industry). The performance of the assets is continuously being improved by local Hines teams with the close involvement of tenants.

M&P offers Hines a sustainability toolbox

With individual decarbonisation concepts, the M&P Energy team offers Hines the right mix of a strategic and economic overview, technical knowledge, creative ideas and engineering implementation expertise to achieve the targets that have been set.

In order to develop the concepts, the property is inspected with the project team and the FM service provider on-site, as well as the property managers and asset managers from Hines. Together, the project participants create a Net Zero Carbon Roadmap that considers both the reduction of CO2 and energy-efficiency aspects. After the Energy team has calculated the measures, the final presentation takes place, during which the results are presented and discussed.

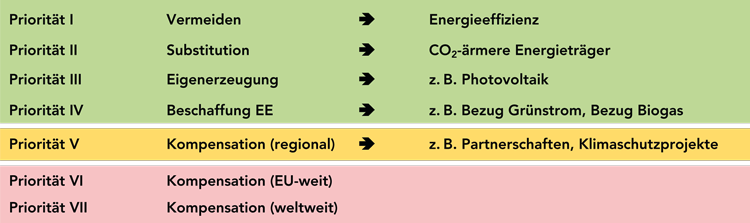

Our Energy team uses the ‘M&P Sustainability Toolbox’ in the development of the concepts – adapted to the needs of the real estate company.

Figure: M&P sustainability toolbox

Priority 1: Identification of energy-efficiency measures

Building automation in particular offers great potential for substantial energy savings. The aim of Hines’ assets is to operate systems in line with demand without significant restrictions on comfort. Examples include the replacement of conventional radiator thermostats and five-litre under-sink storage devices for hot-water supply. There are plans to use electric thermostats that can be centrally controlled in office spaces and pre-set thermostats in communal areas. The five-litre under-sink storage units are to be replaced by small-sized flow heaters. These do not store hot water, but rather make it available as needed.

Priority 2: Substitution of CO2 emissions

The focus of the measures being planned is on heat supply. In the context of decarbonisation, its redesign is at the heart of the measures in most cases. Some of the properties are supplied with district heating from local suppliers. They generally have less ambitious plans to reduce emissions. In order to meet the targets set by Hines, it is often necessary to replace district heating with more sustainable forms of heat supply. In most cases, this involves heat pump solutions. Heat pumps raise the temperature of environmental heat to warm the building. The phase change of the refrigerant generates three to four units of heat from one unit of electricity.

The good building structure of HECF’s assets enables an efficient use case for the implementation of heat pumps. In addition to replacing the heat source, this often requires hydraulic conversion measures such as the integration of concrete core activation, so that the heat in the building can be transferred to the largest possible areas and low flow temperatures can be used. The partial replacement of heating surfaces is another method of resource optimisation. Despite the extensive renovation work involved, the lower operating costs ensure that these measures remain profitable.

Priority 3: Energy generation measures

In this case, the focus is mainly on photovoltaic systems. In addition to rooftop PV systems, we also test other forms such as facade PV systems or solar flowers. Further measures to include the outdoor area are also desired within the context of the project. Examples of this include considering facade greening and a study of the potential of the use of rainwater in existing properties. In line with Hines’ objectives, offsetting can be avoided through the procurement of PPA green electricity for the communal areas and the ongoing integration of green leases.

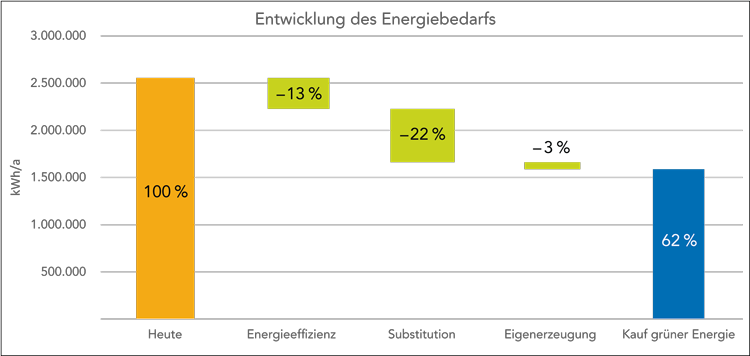

Figure: Potential for reducing energy requirements through M&P measures for one of the Hines assets

From the analysis to a carbon-neutrality roadmap

The analyses are carried out taking into account the individual opportunities and weaknesses of a building with regard to use, the condition of the building and its systems, and the surrounding environment. Following a successful pilot project in Hamburg, M&P’s energy team is creating carbon-neutrality roadmaps for other properties in Frankfurt, Berlin and Stuttgart, with the aim of making them climate-neutral by 2030. For the project in Hamburg, M&P has already been granted a planning contract for the energy-efficient renovation, including building management technology. The planning is to be completed by early 2025.

With its optimally equipped, flexibly deployable sustainability toolbox, M&P is opening up new spaces for a climate-neutral real estate industry.